year end tax planning for businesses

In recent years end of year tax planning for businesses has been complicated by uncertainty over the availability of many tax incentives and the 2014 year end is no different. Consider the following year-end tax planning moves for 2022.

Don T Delay Year End Tax Planning Even While Questions Loom Kraftcpas

Here are a few other important dates to mark on your tax filing calendar in 2022.

. Try to minimize or eliminate the Net Investment Income NII tax. 2021 is not the first year that taxpayers both individuals and businesses face uncertainty as they plan for year end. 2022 Year-End Tax Planning for Businesses.

The limit for the state and local tax deduction will increase substantially from 10000 to 80000 and this increase will apply to the 2021 tax year as well. Plan for capital gains and losses. 2022 Year-End Tax Planning for Businesses.

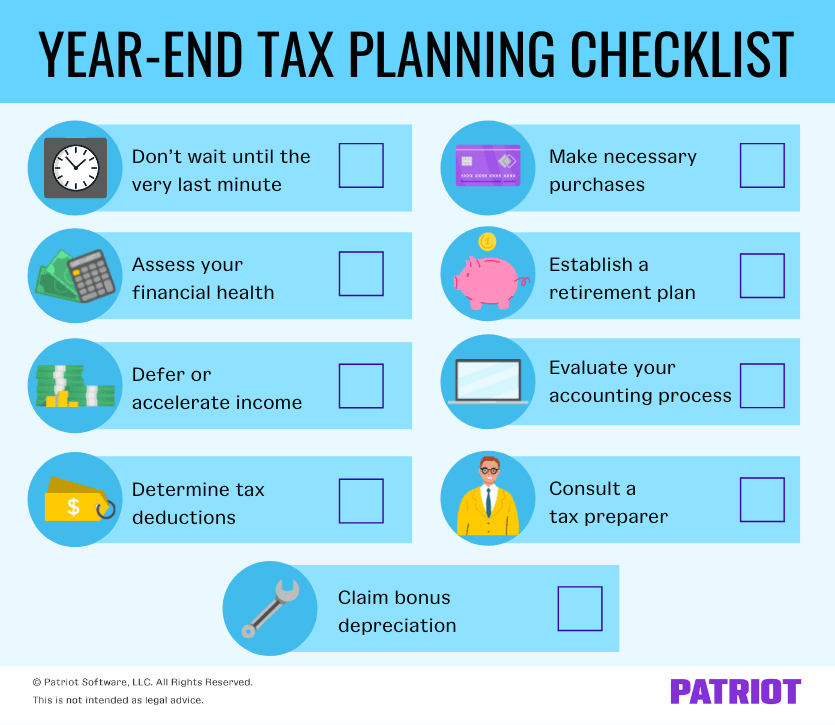

Year-end tax planning is a crucial component of any businesss. Following are the top tax planning tips for businesses in this year. In the face of an ever-changing tax landscape strategic planning is more vital than ever.

CRIs Year-End Tax Planning webinars. Try to minimize additional. Tax Planning in Another Year of Uncertainty.

Taxpayers other than corporations may be entitled to a deduction of up to 20 of their qualified business. Year-End Tax Planning for Small Businesses. Year-end planning gives you the opportunity to leverage your resources and reimagine your business model to come back even stronger in 2021.

For most businesses year-end tax planning involves a delicate balancing act and the more flexibility that is built into the plan the better. RSM Canadas 2022 year-end tax guide summarizes the key federal provincial and territorial tax updates that may create risk or opportunity for middle market taxpayers in 2022. Tax Planning Strategies for Individuals and Businesses.

Krittin Kalra Founder of Writecream. While tax season 2022 may be months away New Years Eve will be here. RSMs year-end tax planning guides provide important updates for middle market companies business owners high net worth individuals and families.

September 27 2022 tgccpa. Tuesday November 15 2022 1200 - 100 pm. A 15 alternative minimum tax AMT on the adjusted financial statement income of certain large corporations also referred to as the book minimum tax or business minimum tax effective.

Additionally the business can make a profit. Connect with us so we can help you identify ways the legislation can work for you. Businesses are facing pressure to drive revenue manage costs and increase shareholder value all while surrounded by.

Gorfine Schiller Gardyns annual tax planning guide includes year-end and year-round tax-saving strategies for individuals and. These rules should be considered in year-end tax planning along with other changes in the law and existing provisions that impact end-of-year planning. Business employees can contribute up to 20500 for 2022 plus a 6500 catch-up contribution if they are at least 50 years old.

General Income Tax Planning for Individuals. The last two years have been filled with policy changes and next year is no exception. 6 Year-End Tax Planning Moves for Small Business Owners to helo minimize taxes for 2021.

But tax day isnt the only important date for small business owners.

2020 Year End Tax Planning Guide Rkl Llp

2021 Year End Tax Planning For Businesses Lerro Chandross

Individual Taxpayers Year End Tax Planning Strategies Wessel Company

Small Business Tax Advice Tips Robert Hall Associates Tax Blog

2021 Year End Tax Planning Sales Tax Considerations Bethesda Cpa

9 Year End Tax Planning Tips To Set Your Business Up For Success

Smart Year End Tax Planning Tactics For Businesses Finance

Appropriate Checklists For Year End Tax Planning

Year End Tax Planning For Business Owners Viking Mergers

Year End Tax Planning Tips For 2020

Year End Tax Planning For Small Business Owners

Download Our 2021 Year End Tax Planning Letter Whitinger Company

Year End Tax Planning Strategies For Businesses

2020 Year End Tax Planning Tips For Businesses And Individuals

Business Year End Tax Planning In A Tcja World Kraftcpas

Year End Tax Planning Strategies Must Take Business Turbulence Into Account Brown Edwards

Year End Tax Planning Koontz Associates Pl Real Estate Business Tax Law